Taxes Quotes

-

Government, not the oil industry, is the biggest 'profiteer' from oil. And it uses the tax revenue to expand its own authority at the expense of the individual, as it does with an endless number of other industries - including electric power, coal, lumber, pharmaceuticals, automobiles, aircraft, and agriculture. The Statist's intrusion to the free market is boundless.

Mark Levin

Mark Levin

-

Politics is very much like taxes - everybody is against them, or everybody is for them as long as they don't apply to him

Fiorello LaGuardia

Fiorello LaGuardia

-

England was killed by an idea: the idea that the weak, indolent and profligate must be supported by the strong, industrious, and frugal – to the degree that tax-consumers will have a living standard comparable to that of taxpayers; the idea that government exists for the purpose of plundering those who work to give the product of their labor to those who do not work. The economic and social cannibalism produced by this communist-socialist idea will destroy any society which adopts it and clings to it as a basic principle – ANY society.

Dan Smoot

Dan Smoot

-

Withholding of payment of taxes is one of the quickest methods of overthrowing a government.

Mahatma Gandhi

Mahatma Gandhi

-

Inheritance taxes are so high that the happiest mourner at a rich man's funeral is usually Uncle Sam.

Olin Miller

Olin Miller

-

Whoever is for higher taxes, feel free to pay higher taxes.

Adam Carolla

Adam Carolla

-

The oil industry is hardly free to operate as efficiently as it could or to be as responsive to consumer demands as it would like. It has become, in essence, a quasi-state-run enterprise, because it cannot drill, transport, refine, and store fuel without receiving government permission, complying with government regulations, and paying taxes at every level or production.

Mark Levin

Mark Levin

-

I am no longer going to go along with this idea that we're going to keep spending and borrowing and taking over and raising taxes, that I'm going to do everything I can to change things.

Chris Matthews

Chris Matthews

-

Talkin bout money we could have a conversation Top five tax bracket in the population

Nicki Minaj

Nicki Minaj

-

Taxation is the legitimate support of government.

Louis Adolphe Thiers

Louis Adolphe Thiers

-

If you look at the performance of the zero-income-tax-rate states and the highest-income-tax-rate states, I believe a large amount of their difference is due to taxes. Not only is it true of the last decade, but I took these numbers back 50 years. And, there's not one year in the last 50 where the zero-income-tax-rate states have not outperformed the highest-income-tax-rate states.

Arthur Laffer

Arthur Laffer

-

The people suffer from famine because of the multitude of taxes consumed by their superiors. It is through this that they suffer famine.

Lao Tzu

Lao Tzu

-

Trump can, like every government, trigger a short boom with borrowed money, just like he has announced. He appears to want to adopt the economic policy approach favored by Republicans of putting lots of money into building roads and cutting taxes. Markets like that. But, at the end of the day, someone always has to foot the bill.

Nicholas Bloom

Nicholas Bloom

-

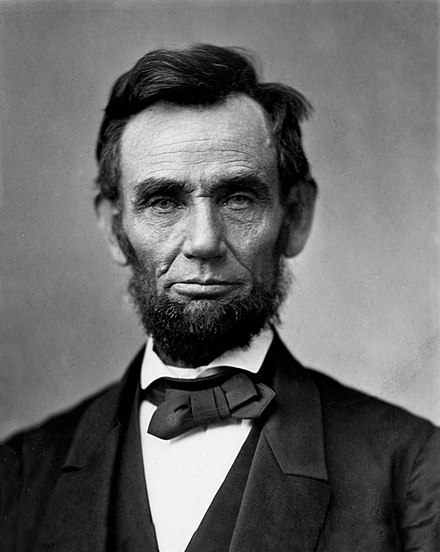

..avoiding likewise the accumulation of debt, not only by shunning occasions of expense, but by vigorous exertions in time of peace to discharge the debts, which unavoidable wars may have occasioned, not ungenerously throwing upon posterity the burthen, which we ourselves ought to bear.

George Washington

George Washington

-

Multi-millionaires who pay half or less than half of the percentage of tax the rest of us pay justify their actions by saying they pay what the law requires. Though true, the fact is they found ways within the law to beat the purpose of the law - which, in the case of taxes, is that we all pay our fair share.

Simon Sinek

Simon Sinek

-

I'm from California, I know what's up with this. You keep raising people's taxes eventually they are going to say no.

Sean Hannity

Sean Hannity